Want it delivered daily to your inbox?

-

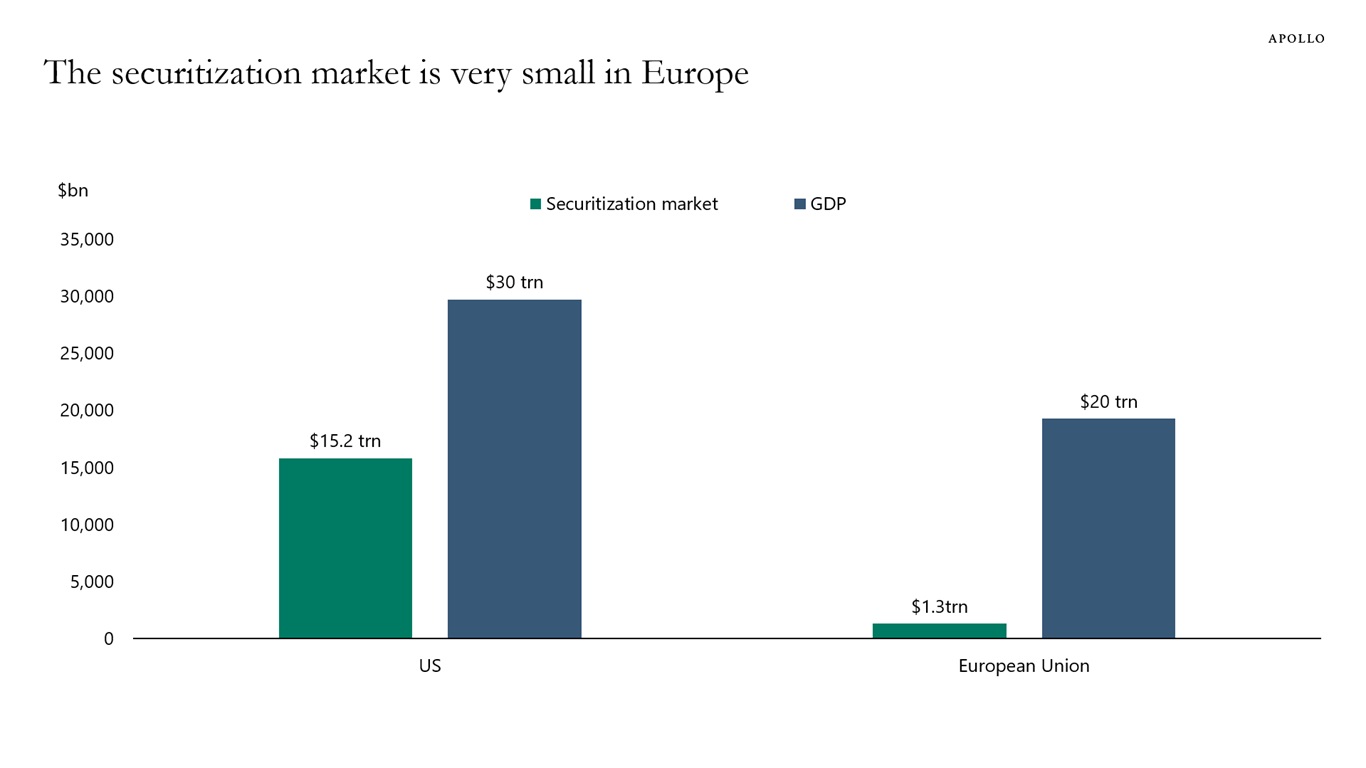

In the United States, the securitization market is 50% of GDP. In Europe, securitization markets are only 7% of GDP, see chart below.

Expanding the securitization market in Europe would unlock significant GDP growth in Europe.

Sources: SIFMA, AFME, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Our latest outlook for China is available here.

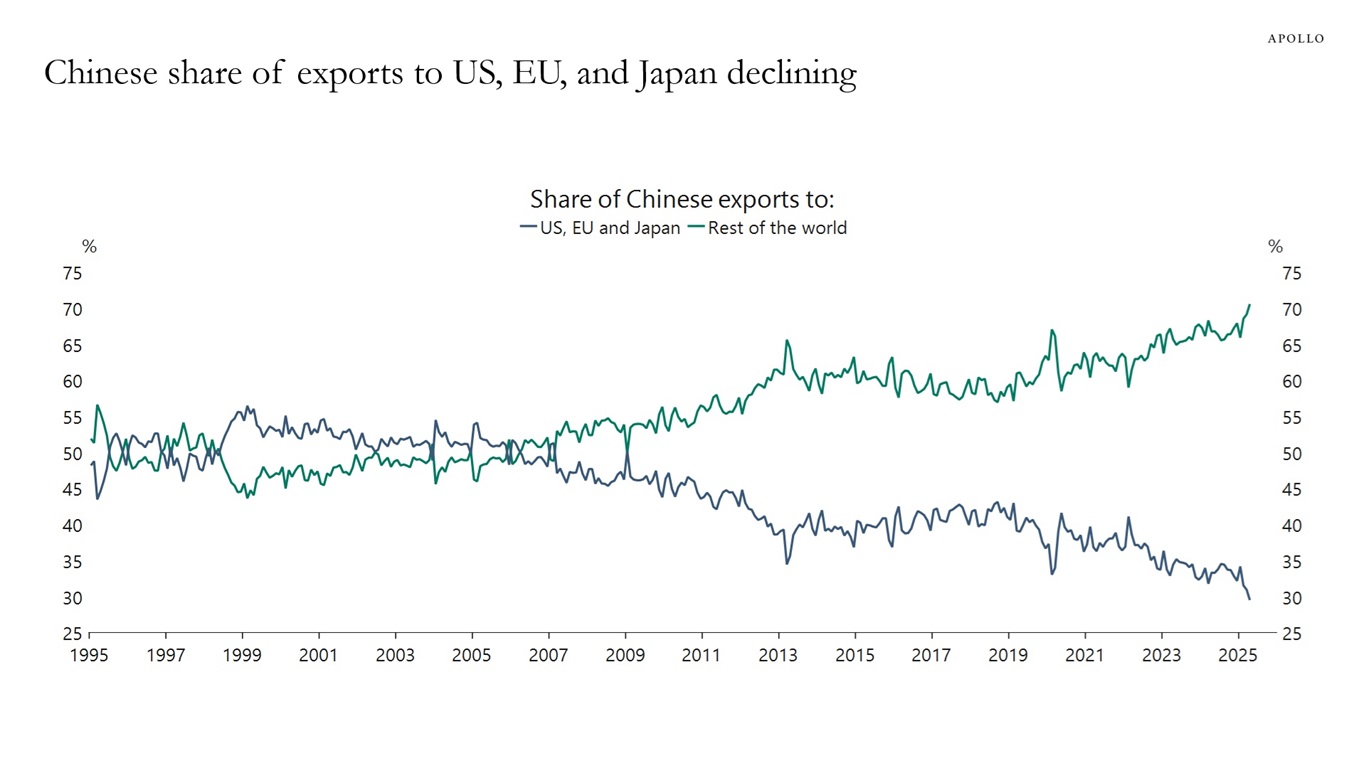

The consensus predicts a decline in China’s growth from its current rate of around 5% to 4% next year.

The forces pulling growth down are the ongoing trade war with the US, the deflating housing bubble, and demographic headwinds as the lagged effects of the one-child policy continue to shrink the working-age population.

Sources: Bloomberg, Macrobond, Apollo Chief Economist

Sources: Bloomberg, Apollo Chief Economist (Data as of June 2024)

Sources: China General Administration of Customs (GAC), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Our outlook for the US banking sector is available here.

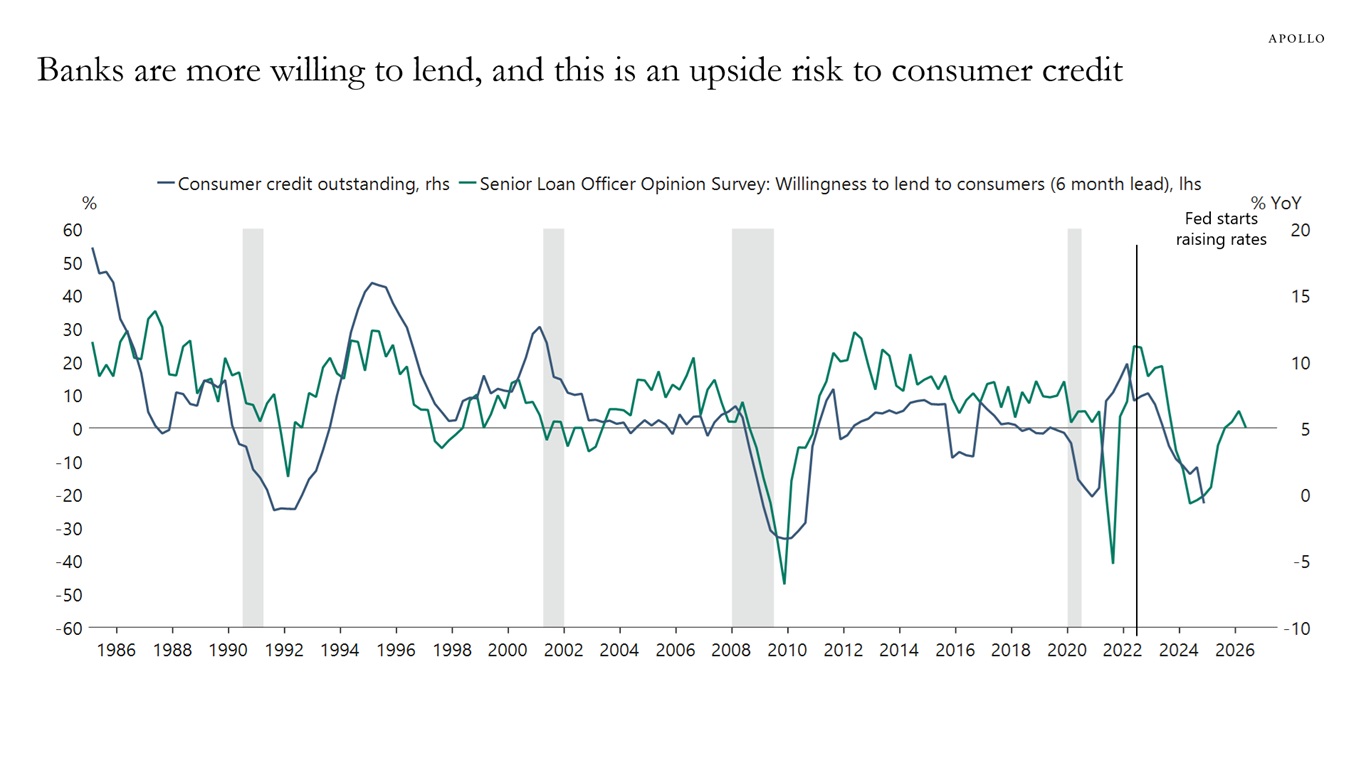

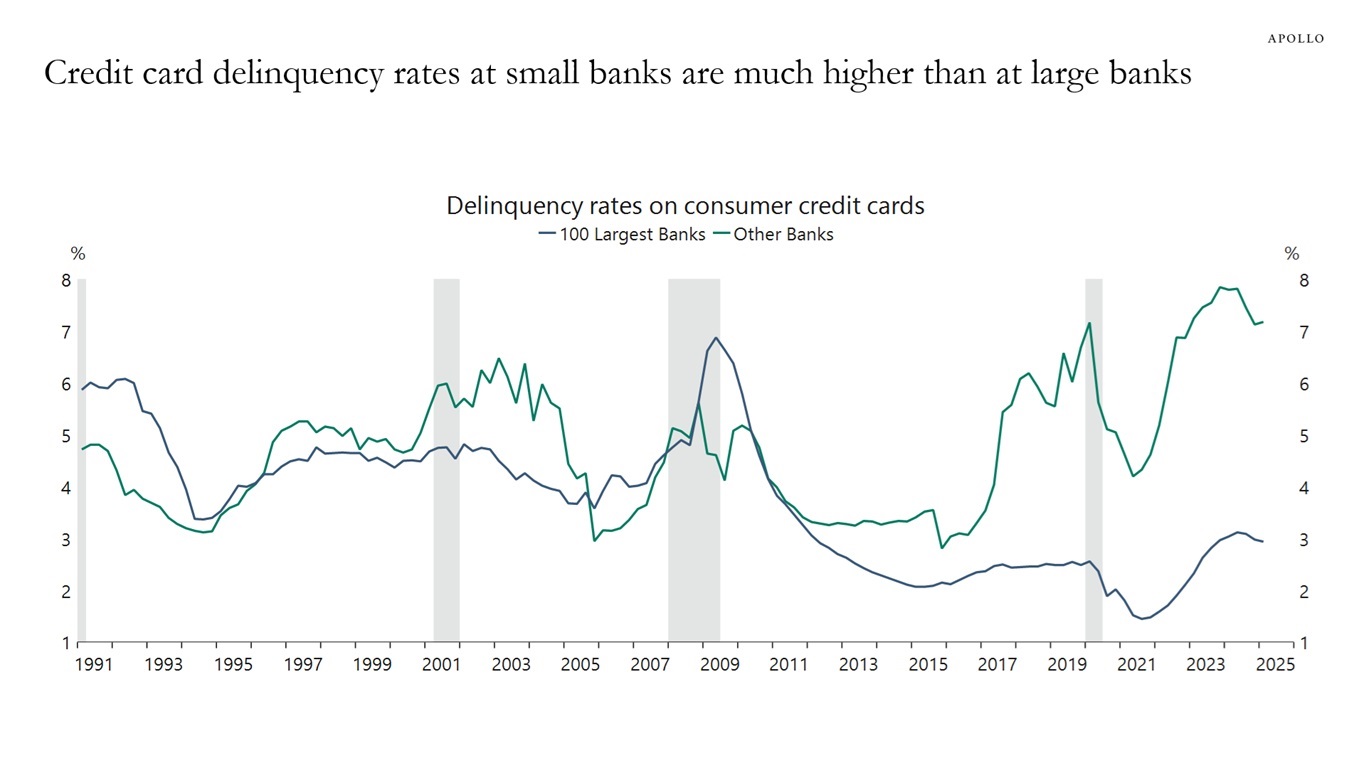

Banking sector balance sheets are generally in good shape, and credit growth is positive, driven by lending by large banks.

Delinquency rates are peaking on credit cards and auto loans, but restarting student loan payments is a headwind to credit quality and credit growth.

The trade war and Moody’s downgrade have not yet had any impact on the banking sector or credit growth.

Permanently higher interest rates are putting downward pressure on CRE prices for office, multifamily apartments, and healthcare facilities. This remains a problem for banking sector balance sheets.

Sources: Federal Reserve, Macrobond, Apollo Chief Economist

Sources: Federal Reserve Bank of New York, Macrobond, Apollo Chief Economist

Sources: Federal Reserve Bank of New York, Macrobond, Apollo Chief Economist

Sources: Federal Reserve, Macrobond, Apollo Chief Economist

Sources: Bloomberg, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

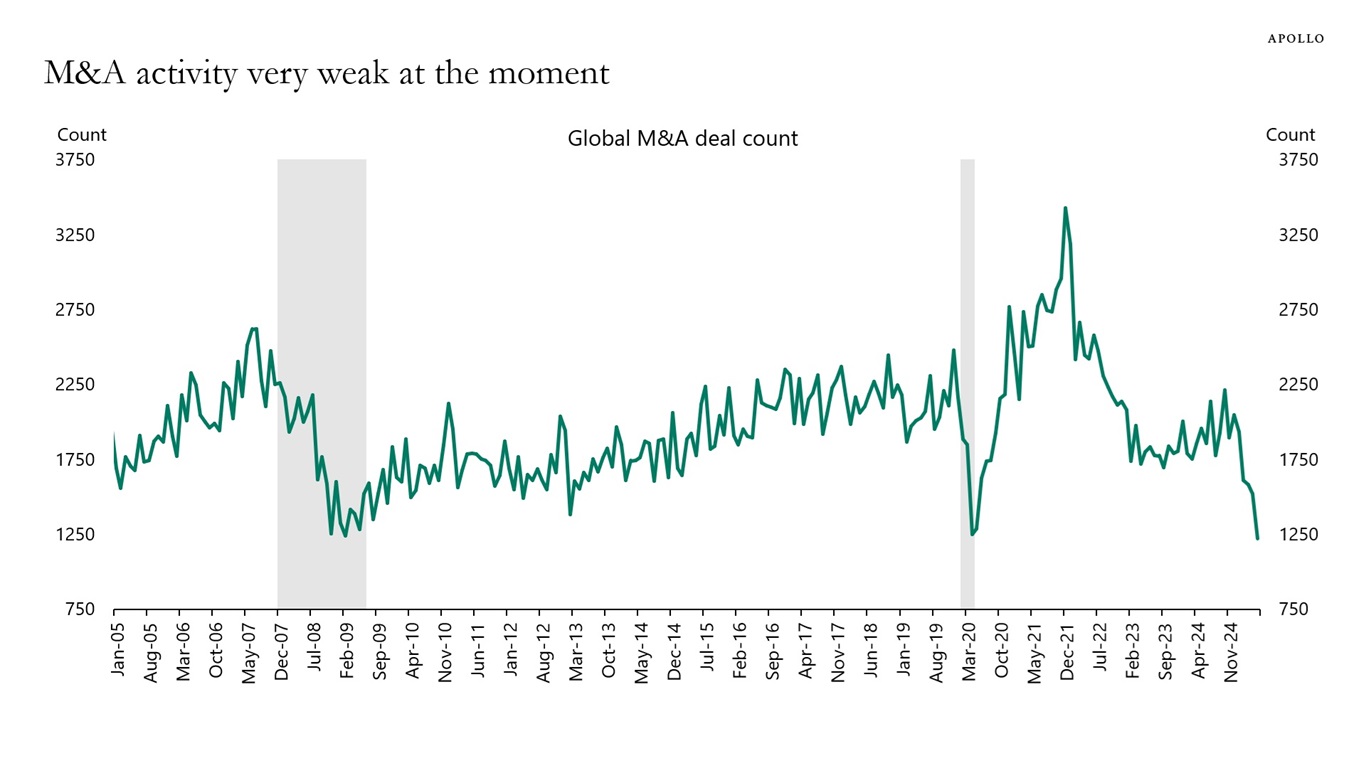

Measures of M&A activity are approaching the lowest levels in decades, driven by the double whammy of high uncertainty for business planning and interest rates staying higher for longer.

The weak M&A environment will continue.

Why? Because unsustainable fiscal policy is putting upward pressure on long-end rates, while inflation is putting upward pressure on front-end rates, driven by tariffs, reduced immigration, and housing affordability boosting rental inflation.

The bottom line is that fixed income will continue to pay higher all-in yields to asset owners of credit.

Note: Data uses completed M&A deals from MA<GO> screen on Bloomberg. Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

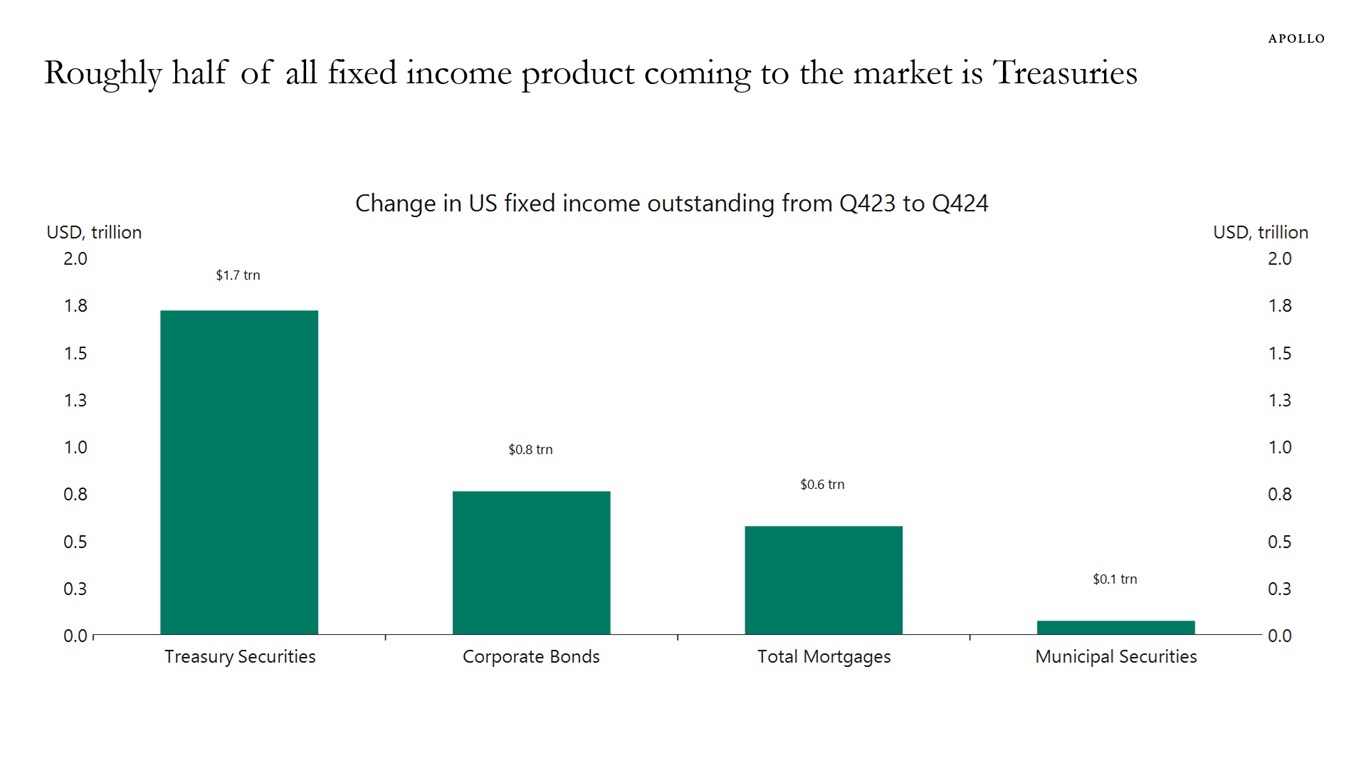

Over the past 12 months, roughly half of all fixed income product coming to the market has been Treasuries, see chart below.

This is not healthy. Half of credit issued in the economy should not be going to the government.

The consequence is that investors need to allocate more and more dollars to finance the government rather than financing growth in the economy through loans to firms and consumers.

The bottom line is that if the level of government debt were significantly lower, more dollars would be available for consumers to buy new cars and new houses, and for companies to build new factories.

Sources: Federal Reserve, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Over the past 10 years, 98% of active managers in Treasury fixed income funds have underperformed their benchmark. For active managers in public investment grade credit, the share is 82%, and for active managers in public high yield, the share is 79%. In fact, the data below from S&P shows that over the past decade, active managers in public fixed income have underperformed their benchmarks across all strategies, see chart below.

Note: Data as of December 31, 2024, based on absolute return. Sources: S&P SPIVA scorecard, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

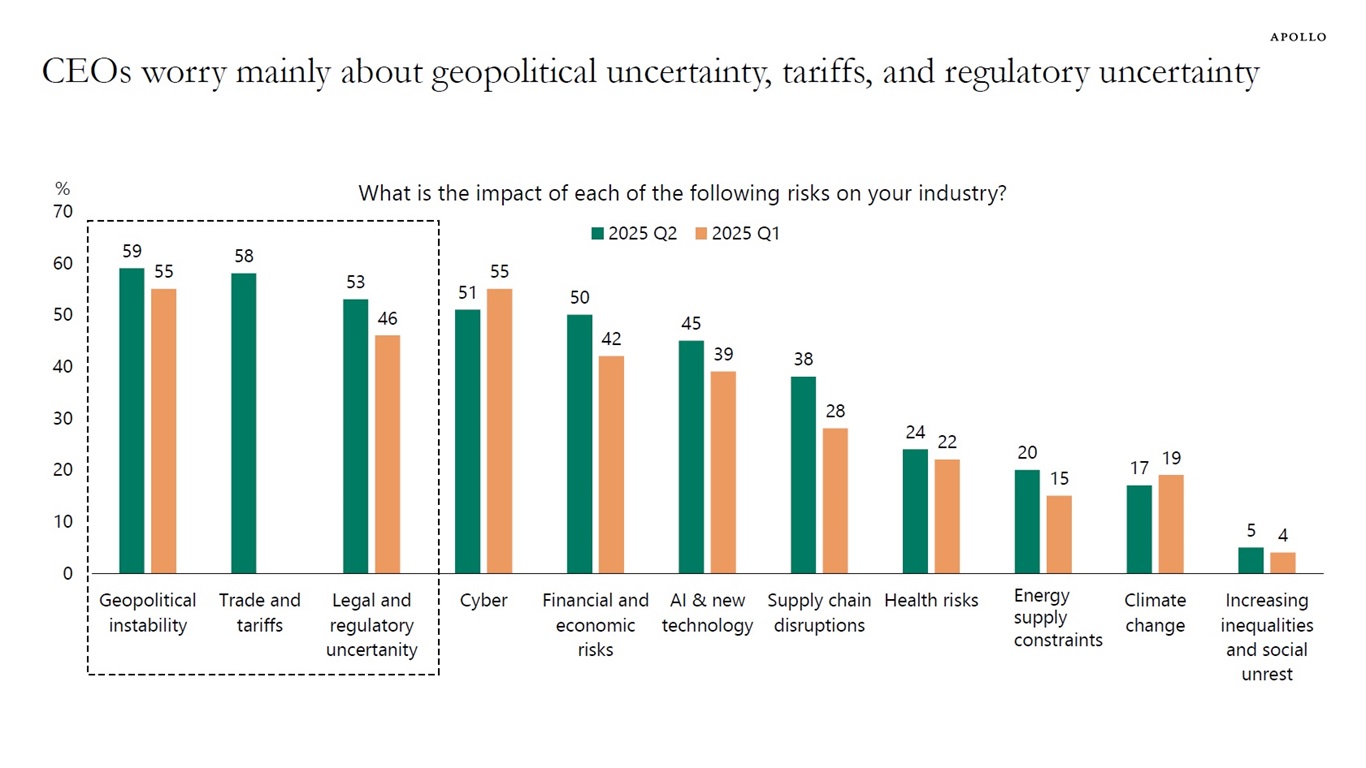

Surveys show that the top three risks for CEOs are geopolitical instability, trade and tariffs, and legal and regulatory uncertainty, see chart below.

Data is based on “CEO Confidence Declined Significantly in Q2 2025.” Sources: The Conference Board Measure of CEO Confidence in collaboration with The Business Council, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

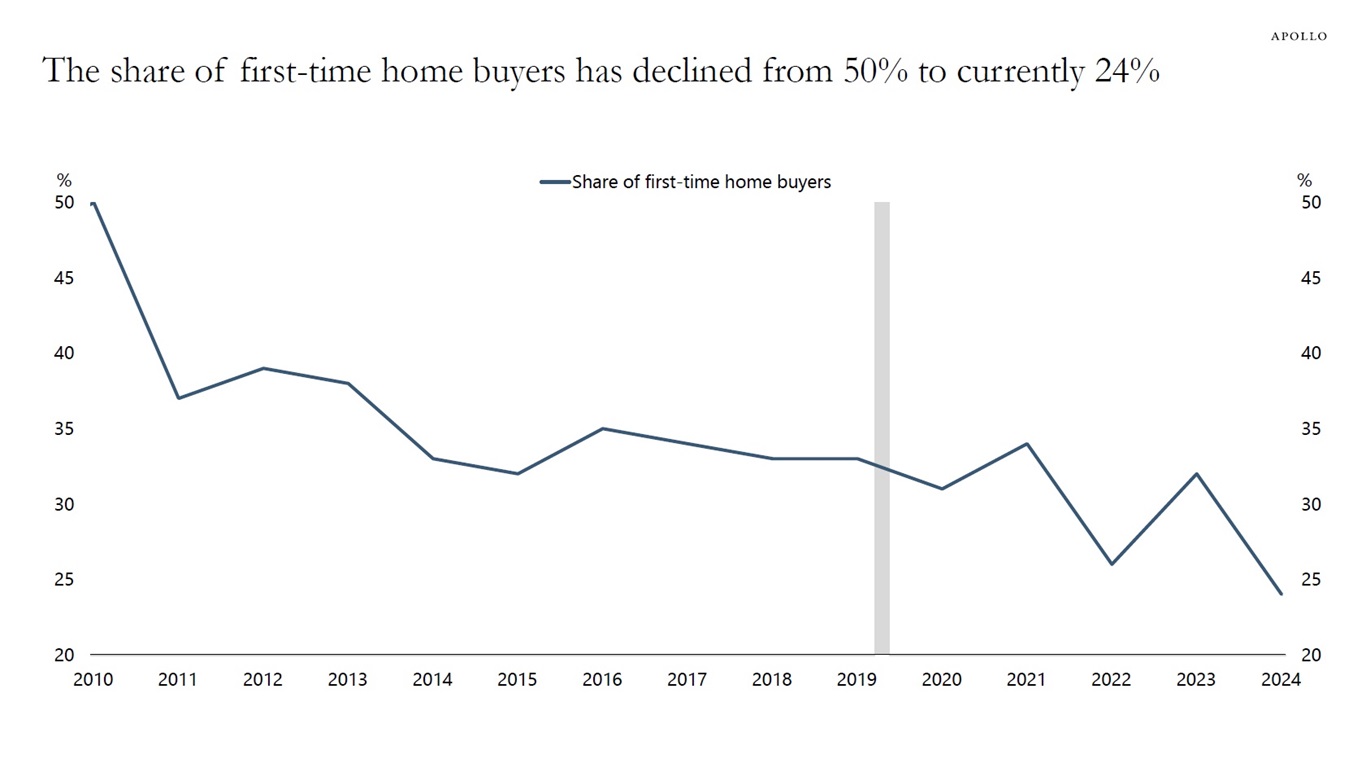

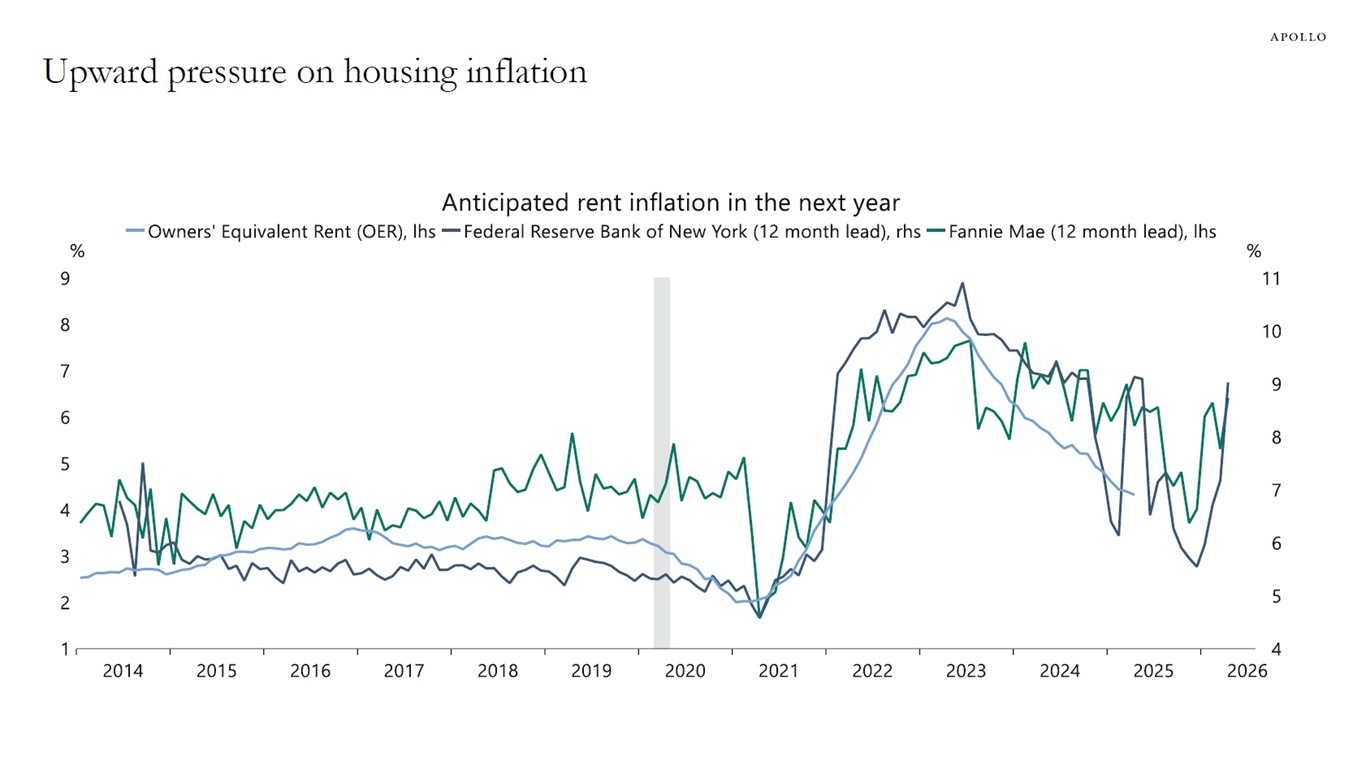

With mortgage rates close to 7% and home prices at all-time highs, the share of first-time home buyers as a share of all houses sold has declined from 50% in 2010 to only 24% today, see the first chart below.

With fewer new households able to enter the housing market, affordability is putting upward pressure on rents, which is a problem for the Fed, see the second chart.

Sources: National Association of Realtors, Apollo Chief Economist

Sources: Federal National Mortgage Association (Fannie Mae), Federal Reserve Bank of New York, US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

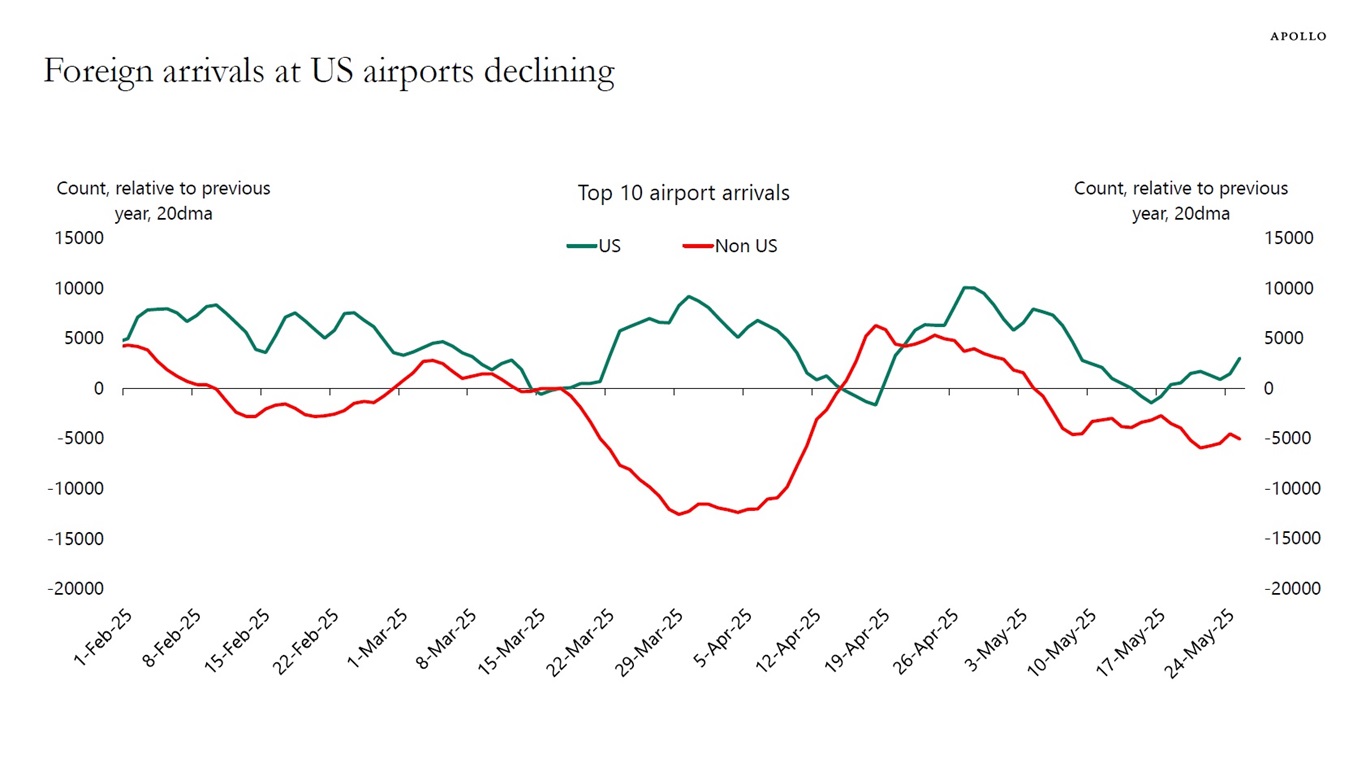

Foreign arrivals at the top 10 busiest US airports continue to decline, see chart below.

Note: Airports included are ATL, LAX, DFW, MIA, ORD, DEN, IAD, SFO, MCO, and JFK. Sources: CBP, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

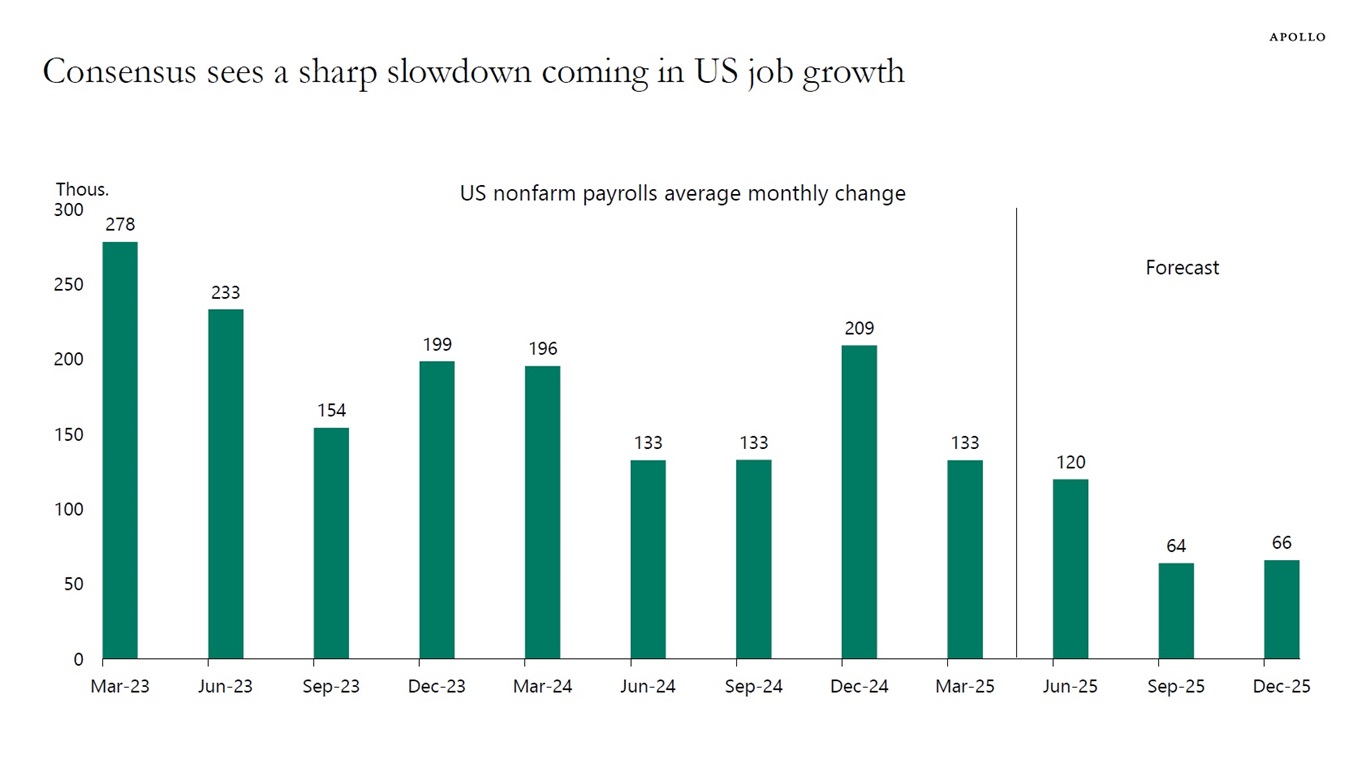

The consensus is forecasting a sharp slowdown in nonfarm payrolls over the coming quarters, see chart below.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.